Five Steps to Financial Freedom

- DEBT: Get rid of high interest debts like credit card debt then personal and then car loans. If possible get rid of all debts.

- INSURANCE: Get term life insurance (you get nothing back if you live till end) covering between 100 to 200 times your monthly expenses and health insurance floater plan for entire family that can cover an open heart surgery.

- EXPENSE < INCOME: Try and get your expenses as low as possible while still being happy. Spending only half of your income (or 50%) would be a cool target

- INVEST: Put half of the saved income into PPF/VPF/FD etc and other half into Index Mutual Fund or Index ETF (easy to open even on PayTM Money in half day)

- CONGRATS: Relax and allow the money to grow till it becomes at least 400 times your monthly expenses. Hurrah!

Personal Finance Calculators

The personal finance calculator has five sheets (Current Version 2.0)

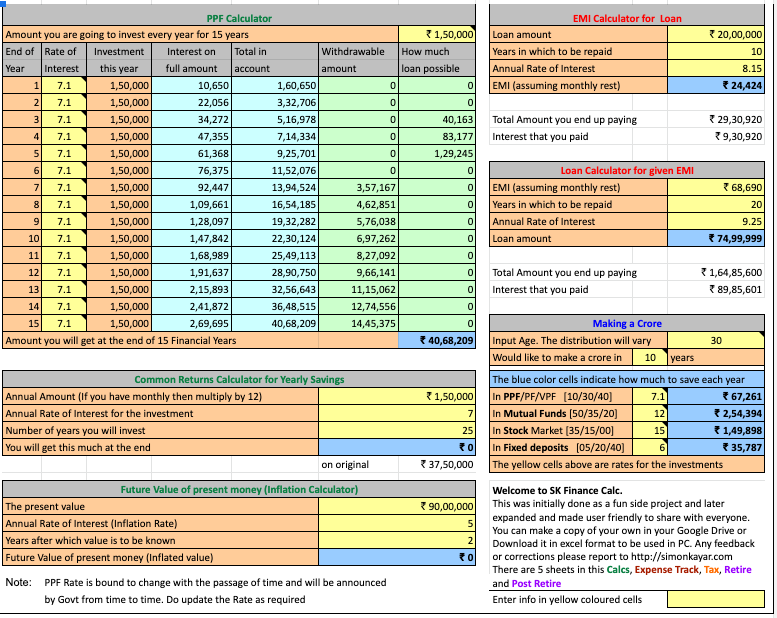

- Calcs: Finance calculators for PPF, EMIs and general returns

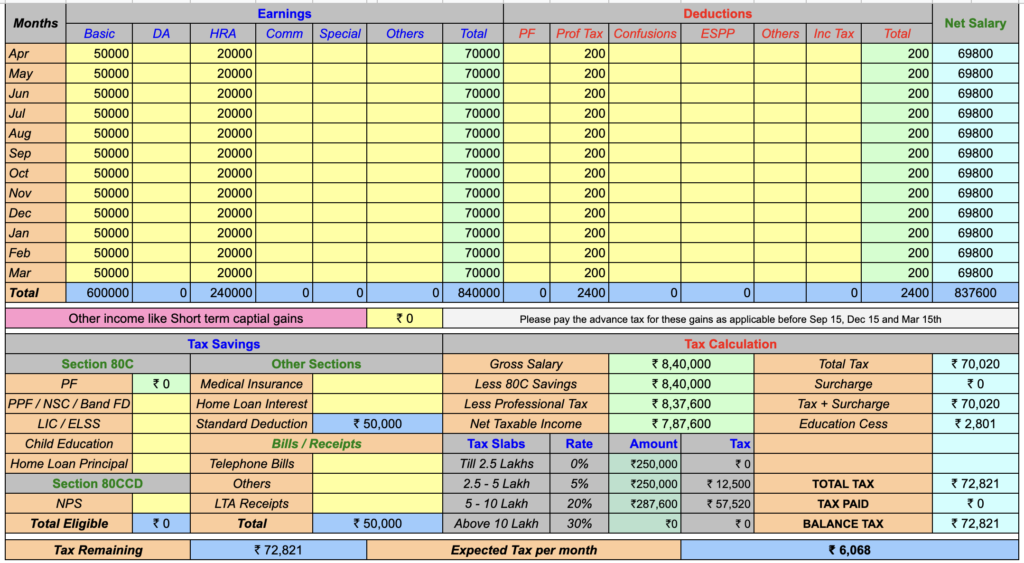

- Tax: Income Tax Calculators for personal use [changes when tax law changes]

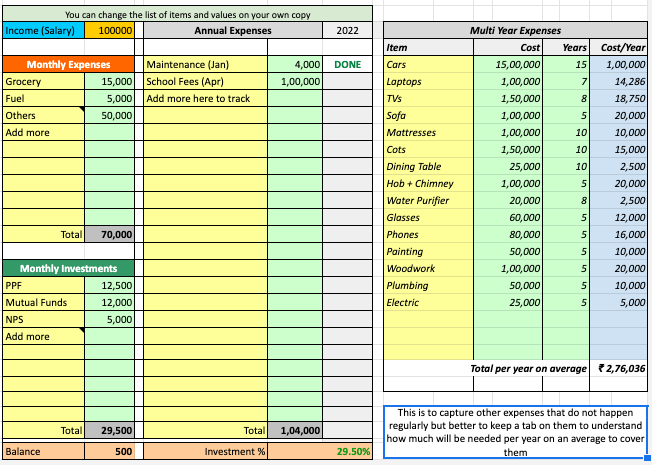

- Expense Track: To track your monthly, yearly and multi year expenses and investments

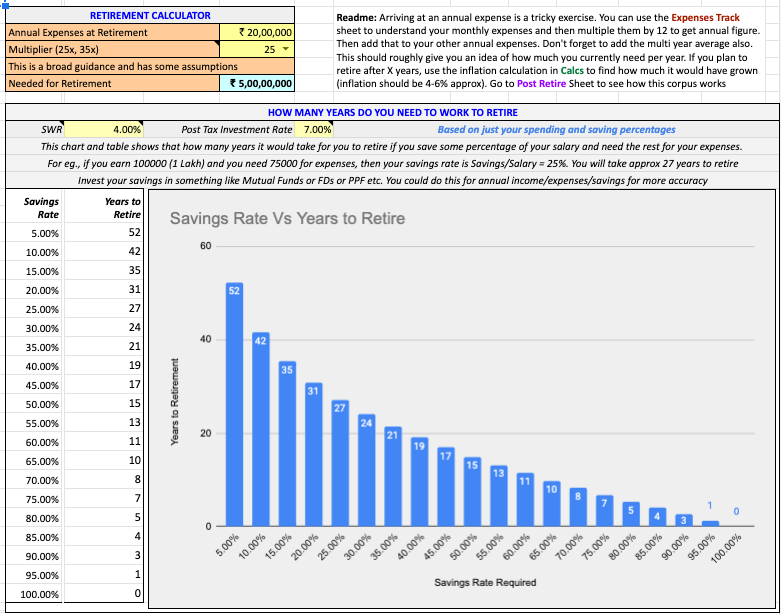

- Retire: Sheet to evaluate how much you need to retire and when you can retire

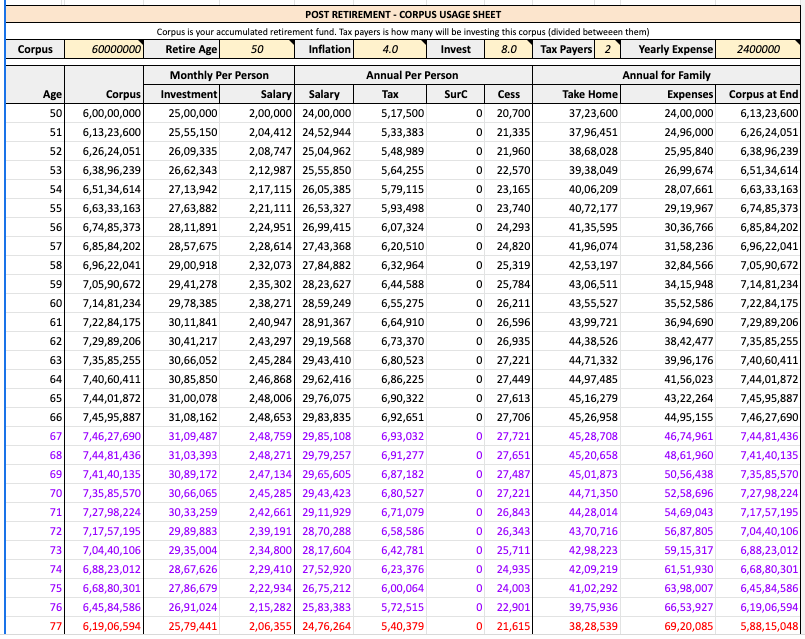

- Post Retire: Usage of Retirement corpus every year till it is all gone [changes when tax law changes]

Download “Personal Finance Calc” [Google Sheets]

How to use the sheets

- The PPF calculator is for the “Public Provident Fund” scheme of the Indian Government. You contribute every year for 15 years and get reasonably good rates (Better than FDs at least) for the money. The interest is also tax free (as of 2023 at least). So you can enter how much you plan to save each year and because the interest keeps changing each year you have to enter it in the yellow cell for each year or just use something appox.

- The EMI calculators come in 2 flavors, enter loan amount and the years to repay with interest and get EMI or enter what EMI you can pay with years and interest to get what loan you are bound to get.

- To evaluate any investment the “Common Returns” calculator is useful. Just enter annual amount, interest and years and it will show how much you can get by the end. Useful to quickly check any investment including FDs, Stock or anything else for that matter.

- The “Future value” is like Inflation calculator. So if you want to find how much your costs will become in future, you can check here by giving the current cost, inflation rate and years to find what it will become later. Useful for things like checking future college fees for your kids 🙂

- Making a crore is just a fun way to check how long and how much in each investment will take you to a Crore. Your age helps the tool to try and distribute the risks accordingly.

- The expenses sheet is to just have a plan for your monthly salary and to quickly check if there are pending payments. There is also an annual section to track various random expenses that happens over the year and to ensure you pay them on time and to plan for it. There is a section for monthly investments also (This also helps you compute your savings rate or investment percentage). There is a section also for ‘Multi Year Expenses’ so that you can plan for expenses that happen once in a few years like Cars, TVs, phones etc.

- The income tax calculator may be a bit tricky if you have never actually paid attention to your salary slip and taxes but try it. Take you salary slip and try to map things such that the net salary matches for a month. You can change the sections like DA, HRA or ESPP to match your own salary slip headings. This is just a rough guidance. Please don’t blame me for not paying taxes 🙂

- The ‘Retire’ sheet has the ‘Retirement Calculator’ to identify how much you will need approximately to retire. There is also a graph and table that shows how long you have got to work because of your current money habits before you can retire. For example if you save half your salary (50% savings rate), then you probably just need to work 15 years on an average to get enough for retirement. Again this is a very rough guidance and does not consider every eventuality.

- The ‘Post Retire’ sheet has a table showing how your retirement corpus will get used depending on your annual expenses, the inflation rate and the investment rate. Here you can actually see the money growing and falling every year in your retirement till it dries up completely and goes to zero at a particular age. Again this just assumes that you will continue to spend the same annually till your last breath but at least it gives you a rough picture.

Please note, this is a shared google sheet that you should make a copy of and use. It is made and shared as a fun guidance project. If you end up not paying taxes or not accumulating enough due to any bug in this sheet don’t blame me. You have been warned. With very little effort you can even edit it to match your needs perfectly. Feel free to use / share with anyone. It it totally free and devoid of any copyrights.